Should you work in monetary providers, the strain: extra information, extra danger, extra expectations to ship outcomes—typically with fewer sources and tighter rules. I’ve been on this business lengthy sufficient to see the cycles, however what’s taking place now feels completely different. At this yr’s Information + AI Summit, the power was palpable. And once I have a look at the most recent survey outcomes, that includes insights from 150+ business leaders, and business analysis, it’s clear: we’re not simply speaking about transformation—we’re residing it.

Let’s look at what’s actually taking place on the bottom and the way the most recent Databricks improvements and market shifts may also help us all transfer from ambition to motion.

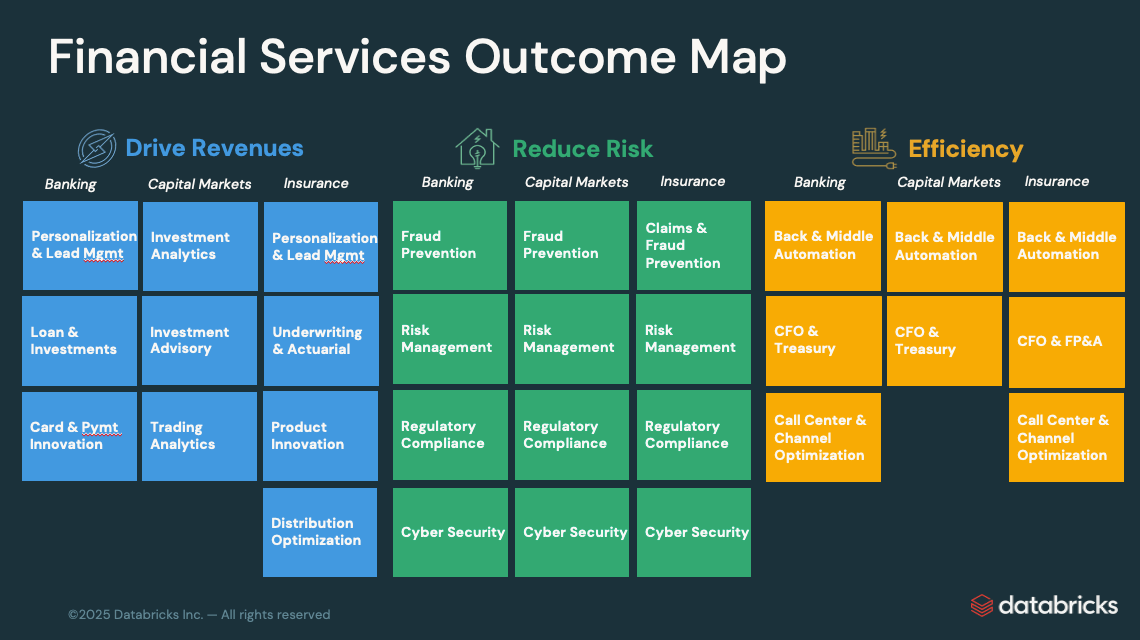

Driving Income: From Personalization to Predictive Analytics

Development right this moment means figuring out your buyer higher than ever—and performing on that information at scale. Our survey confirmed that 56% of banks are prioritizing personalization and lead administration as their high AI use instances, aiming to ship tailor-made experiences that drive new enterprise. In capital markets, 70% are doubling down on funding analytics to make smarter, sooner choices, whereas 79% of insurers informed us that underwriting and actuarial analytics are their predominant focus for information and AI.

Trade analysis backs this up: almost 70% of monetary providers leaders report that AI has elevated income by 5% or extra, and a rising quantity are seeing 10–20% income boosts. Buyer expertise and engagement are among the many high generative AI use instances delivering ROI, with banks leveraging AI to generate $340 billion in further working earnings within the U.S. alone.

That’s why I’m genuinely enthusiastic about instruments like AI/BI Genie (GA), which lets anybody ask questions in plain English and get prompt, actionable insights. With Mosaic AI Agent Bricks (Beta), constructing AI brokers for shopper sentiment or next-best-offer is lastly inside attain—even for groups with out deep technical experience. And with Lakebase unifying operational and analytical information, you possibly can energy real-time insights for every part from customized affords to smarter danger pricing. I’ve seen how Databricks Apps (GA) and the brand new Databricks One (Personal Preview) interface are serving to groups launch new data-driven merchandise sooner than ever—no IT bottlenecks, simply outcomes.

Defending the Agency: Threat, Fraud, and Compliance in Actual Time

Threat by no means sleeps, and neither can we. In keeping with our survey, 73% of banks are placing fraud prevention on the high of their agenda. In capital markets, 77% say regulatory compliance is their predominant focus, whereas 75% of insurers are zeroing in on danger administration.

Trade developments present why: AI-driven fraud detection can reduce operational prices by as much as 50% and velocity detection by as a lot as 95%. Almost two-thirds of monetary providers corporations have both applied or are planning to implement AI for danger administration, compliance, and cybersecurity within the subsequent yr. The sector is main all others in AI adoption, with 85% of corporations anticipated to make use of AI throughout a number of enterprise capabilities by the top of 2025.

On the Summit, it was clear: the stakes are larger, however so is our means to reply. MLflow 3.0 provides us end-to-end mannequin governance, so we will belief the AI choices we deploy. Mosaic AI Agent Bricks are making it doable to automate compliance checks and fraud detection—saving time, decreasing errors, and liberating up our groups for extra strategic work. Safety upgrades like Serverless Egress Management, Personal Hyperlink, and Multi-Key Safety imply we will preserve delicate information locked down, whilst we scale. And with Unity Catalog (now with full Apache Iceberg™ help), we lastly have unified governance throughout all our information belongings, making audits and regulatory reporting a complete lot simpler. Should you’re occupied with modernizing your information warehouse, Lakebridge (GA) affords a free, AI-powered migration path that’s quick and safe.

Changing into Extra Environment friendly: Automation and Collaboration for the Win

Effectivity isn’t only a buzzword—it’s survival. Our survey discovered that 60% of banks, 82% of capital markets corporations, and 62% of insurers are prioritizing again and center workplace automation. Trade analysis exhibits that AI-driven automation is delivering as much as 40% decrease bills and decreasing operational prices by 20–50% for early adopters. Monetary establishments are investing in digital transformation at document ranges, with almost 90% of banks growing IT budgets by at the least 10% in 2025.

This yr’s bulletins felt like a direct response to that want. Lakeflow Designer lets groups construct strong information pipelines visually—no code, no bottlenecks. Databricks Lakeflow unifies information engineering, so we will transfer from ingestion to perception with out handoffs or delays. Databricks Clear Rooms at the moment are usually accessible, making safe, privacy-safe collaboration with companions and regulators a actuality. And with Delta Sharing, Databricks Market, and expanded Unity Catalog governance, sharing and monetizing information is lastly as straightforward appropriately. I’m additionally enthusiastic about Declarative Pipelines in Apache Spark™, that are making pipeline improvement accessible for everybody, not simply engineers.

Why This Issues—and What You Ought to Do Subsequent

The analysis is evident: monetary providers is main the way in which in AI adoption, with measurable ends in income, danger administration, and effectivity. The window for aggressive differentiation is narrowing—corporations that orchestrate AI throughout the enterprise are already outperforming the market, whereas people who hesitate danger falling behind.

Should you’re able to see what’s doable, join along with your Databricks account govt. Let’s discover how one can leverage new capabilities like Lakebase, Agent Apps, and Unity Catalog Metrics to hit your objectives. Ebook a fast 15-minute technique name to debate the newest bulletins, see a brief demo of Information Intelligence in motion, and plan a workshop tailor-made to your wants.

The way forward for monetary providers is right here. Let’s construct it—collectively.