The round financial system, as soon as an aspirational idea, is changing into standardized throughout enterprise, from product labels to worldwide frameworks. And the motion will attain a brand new degree when the World Circularity Protocol (GCP) debuts in November on the U.N. Local weather Change Convention (COP30) in Belém, Brazil.

The brand new protocol — spearheaded by the World Enterprise Council for Sustainable Growth (WBCSD) and backed by 50 firms together with Philips, Cisco and Apple — presents a standard language and information requirements to assist corporations flip away from extractive and polluting practices.

However the metric is way from the one one presently in play within the round financial system. Up to now yr a wide range of organizations, together with B Corps and Underwriters Laboratories, have embedded facets of circularity into their enterprise metrics.

“Round financial system is type of the brand new child on the block” within the quickly evolving house of sustainability frameworks and requirements, stated Alasdair Hedger, the Ellen MacArthur Basis’s senior skilled in efficiency measurement and reporting.

Enterprise leaders might want to perceive and apply these requirements to achieve the rising round financial system,

New methods to measure what’s round

In line with Hedger, circularity frameworks will be organized into 4 classes: product, company, sector and systemic. The World Circularity Protocol grew out of a need to harmonize what amounted to decentralized efforts.

Right here’s a sampling of circular-economy issues being embedded throughout enterprise at every degree:

Product

The Cradle to Cradle Merchandise Innovation Institute in late 2024 added the C2C Licensed Circularity pathway to its already rigorous suite of certifications. It encourages corporations to develop round merchandise as diverse as stitching thread and window glass. There are scores of different shopper product certifications, comparable to these in Amazon’s Local weather Pledge Pleasant program, however most don’t tackle the total vary of circularity attributes.

Company

The approaching World Circularity Protocol matches right here. So do the newest B Corps requirements, which in April added Environmental Stewardship & Circularity as a core matter to advance non-virgin supplies and prohibit “pointless” single-use merchandise and packaging.

As well as, the Taskforce on Nature-related Monetary Disclosures (TNFD) and the Science Primarily based Targets Community (SBTN) are pushing corporations to set nature-positive and science-based targets, which are sometimes suitable with circularity.

Sector

Efforts embrace Underwriters Laboratories’ publication in April of recent round requirements for EV chargers and different power tools. ASTM’s technical requirements apply throughout sectors, too.

Additionally galvanizing sector-level change: company commitments and collaborations, together with the U.S. Plastics Pact, the Ellen MacArthur Basis’s New Plastics Economic system and the Round Electronics Partnership.

Systemic

Within the EU, 2025 has been a milestone yr for the primary financial reporting necessities for the round financial system beneath the Company Sustainability Reporting Directive (CSRD). Plus, prolonged shopper accountability legal guidelines for packaging and textiles are spreading in U.S. states, notably California.

The Worldwide Requirements Group (ISO) is creating steering for adopting round enterprise fashions, following the Might 2024 launch of its ISO 59004:2024 definition of round financial system rules and terminology.

In the meantime, the Worldwide Sustainability Requirements Board and the World Reporting Initiative (GRI) are collaborating to harmonize reporting requirements, together with the mixing of circular-economy rules in sustainability and ESG reporting requirements.

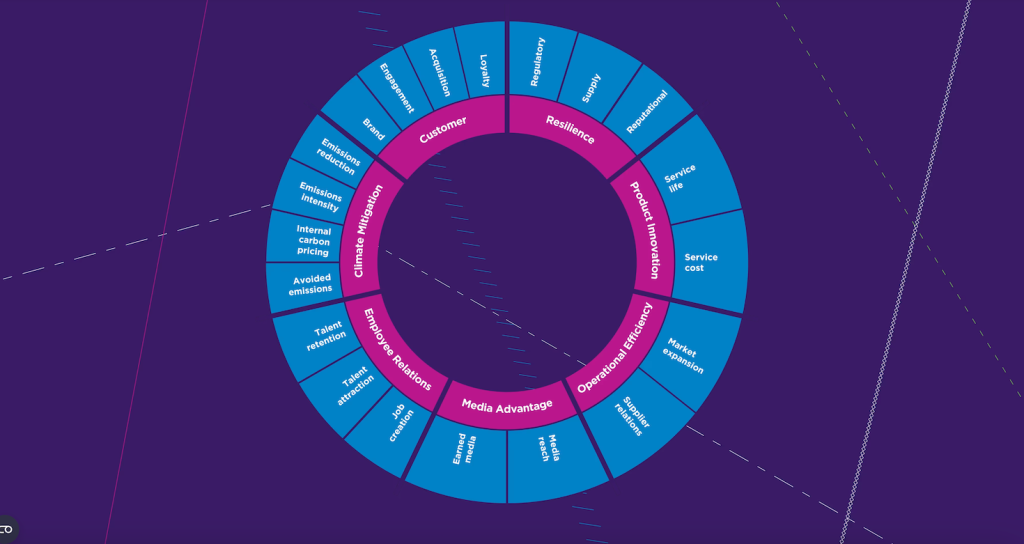

In a world knowledgeable by circularity adherence, corporations should look past a purpose of doing no hurt. “It’s about creating worth,” Hedger stated. That’s, corporations that operationalize and measure round practices can seize strategic benefits, scale back future dangers and enchantment to buyers.

Equally, Filipe Camaño Garcia, the World Enterprise Council for Sustainable Growth’s senior supervisor of the World Circularity Protocol, positions the brand new normal’s potential for “unlocking additional innovation and financing” throughout corporations and areas.

Defining a round future

That’s the idea, anyway. In actuality, extracting assets from nature, creating merchandise from them and losing materials stays the predominant method of enterprise. The truth is, the world is barely much less round than it was a couple of years in the past, in accordance with the most recent Round Economic system Hole report by Circle Economic system and KPMG.

To vary that, round financial system proponents urge corporations to think about the advantages of measuring and sharing their materials and product flows. Figuring out the share of income generated from round enterprise fashions, for instance, demonstrates how round practices feed strategic enterprise objectives. And greedy how a lot income is determined by uncooked supplies can tackle future dangers ought to assets grow to be constrained.

“For these which can be beginning to put in place requirements, there’s a little bit of a primary mover benefit,” stated Adrian Vannahme, chief working officer of Reclay StewardEdge, a Winnipeg, Canada, consultancy that helps shoppers navigate new packaging and waste laws in Europe and North America.

Closing the supplies hole inside emissions counts

In the meantime, there’s a push to combine round financial system rules all through the Greenhouse Fuel (GHG) Protocol, which informs the frameworks of the Science-Primarily based Targets initiative, the CDP’s information reporting, GRI’s sustainability disclosures and emissions measurements by the investor-focused Process Pressure on Local weather-related Monetary Disclosures.

Ellen MacArthur detailed in a January report how legacy sustainability steering inadvertently “disincentivizes” round financial system actions. As an illustration, corporations can’t see the affect of round financial system actions once they measure emissions. Nor can they simply account for the impacts of reselling, repairing or recirculating merchandise and supplies. In flip, it’s exhausting to unlock the enterprise case for round financial system actions. However a clearer view may convey readability to cut back Scope 3 emissions throughout provide chains.

“The round financial system has a key position to play in bringing down emissions,” stated Miranda Schnitger, local weather lead for basis. “It’s not only a gasoline supply query, it’s about how we produce and devour.”