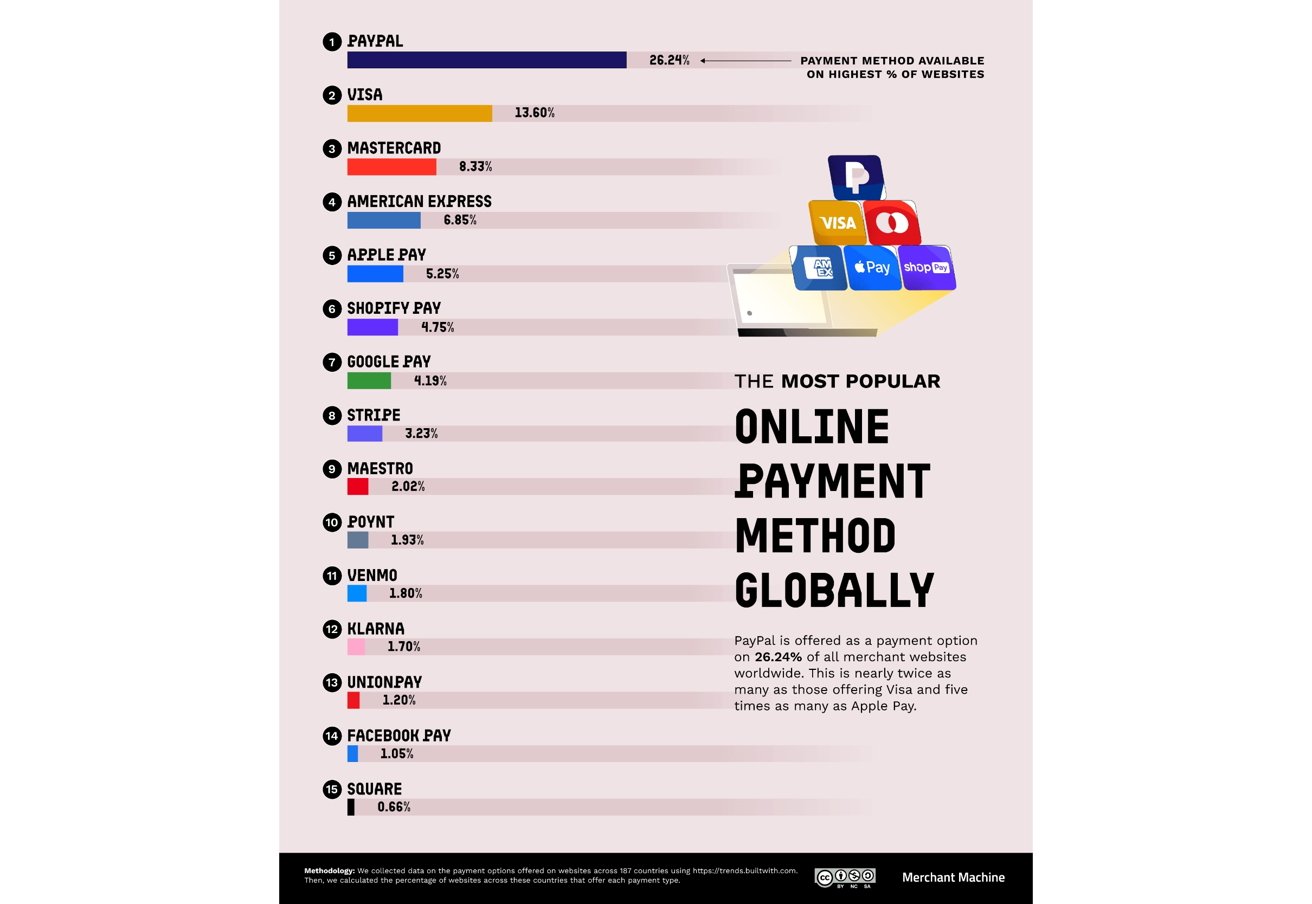

Apple Pay is now the fifth most generally accessible on-line cost possibility as extra consumers ditch conventional checkout varieties for sooner, mobile-first options.

A Might 2025 examine by Service provider Machine discovered Apple Pay is on the market on 5.25% of internet sites globally. That places it simply behind American Specific and forward of Shopify Pay, Google Pay, and Stripe.

PayPal stays the clear chief, showing on greater than 1 / 4 of internet sites at 26.24%.

Saudi Arabia leads in Apple Pay adoption, with over 20% of internet sites providing it. Armenia, Ukraine, Kazakhstan, and the United Arab Emirates additionally rank extremely.

In america, states like Hawaii and Wyoming high the checklist, with greater than 17% of internet sites supporting Apple Pay.

These areas aren’t random. Apple’s market share in Saudi Arabia has grown alongside robust iPhone gross sales, excessive youth engagement with cell expertise, and nationwide funding in digital infrastructure.

Throughout the Gulf, Apple’s ecosystem suits naturally right into a broader push towards digital-first authorities and monetary companies. Apple Pay’s rise in on-line availability displays an extended recreation.

The expansion additionally ties into Apple’s increasing Companies enterprise. In its Q2 2025 earnings, Apple reported $26.6 billion in Companies income, which incorporates Pockets, Apple Card, and Apple Pay.

How Apple Pay works & why it is rising

Apple Pay permits customers to make purchases utilizing playing cards saved on their Apple units. Transactions are confirmed utilizing Face ID, Contact ID, or a passcode.

As an alternative of sending precise card numbers, Apple Pay generates a singular token and one-time code.

That privacy-first strategy has turn out to be a promoting level. Customers do not must share cost particulars with web sites, and biometric verification feels safer than typing in bank card numbers on cell.

The simplicity of Apple Pay helps pace up the checkout course of, which advantages retailers as effectively. Quicker checkouts imply fewer deserted carts, particularly on smartphones.

For retailers and builders, although, there are tradeoffs. Apple requires banks to pay a 0.15% payment per bank card transaction and units strict platform guidelines for apps and web sites that combine Apple Pay.

Some smaller banks and builders have been hesitant to totally embrace the platform because of these limitations.

Apple Pay’s place as a top-five possibility does not essentially imply it sees the identical stage of transaction quantity as Visa or PayPal. In China, cell wallets like WeChat Pay and Alipay dominate every day purchases, and Apple Pay barely registers in market share.

European consumers usually choose Klarna or SEPA-based transfers, relying on the nation.

In lots of of those markets, Apple’s tight management over near-field communication (NFC) expertise has been a sticking level. In July 2024, the European Fee ended an antitrust investigation after Apple agreed to open NFC entry to third-party cost apps.

However in america, the Division of Justice is nonetheless probing whether or not Apple unfairly blocks rivals from providing their very own wallets with tap-to-pay help.

One other constraint is {hardware} exclusivity. Apple Pay solely works on Apple units, which implies Android customers are excluded by design. In Android-heavy areas, that limits its development potential, regardless of how seamless the expertise could also be.

Apple has steadily added new capabilities, similar to increasing Faucet to Pay on iPhone to extra international locations, enabling small companies to simply accept contactless funds with out further {hardware}. Nonetheless, the corporate not too long ago canceled its Apple Pay Later program.

As an alternative, Apple is selecting to accomplice with third-party suppliers for buy-now-pay-later companies going ahead.

The place Apple Pay is headed subsequent

With Apple Pay, Apple Money, Apple Financial savings, and Apple Card underneath its belt, Apple now operates as a monetary platform too. If it expands its partnerships with banks, point-of-sale methods, and app builders, Apple could turn out to be a central a part of on-line cash motion.

Buyers profit from fewer checkout steps and stronger privateness. Retailers see higher cell conversion charges and a streamlined expertise. For builders, Apple Pay is changing into a default expectation for any severe commerce app.