Garmin held its Q1 2025 earnings name this week, and like most different tech manufacturers, it needed to deal with the looming specter of tariffs whereas boasting about its record-setting income. And its future plans are illuminating, each for Garmin followers and tech nerds generally.

Garmin earned $1.54 billion final quarter, an 11% increase pushed primarily by its “Outside” and “Auto” segments, with a “report” $330 million working revenue. And but its shares dipped by about 10% attributable to this earnings report.

Buyers appear spooked by Garmin’s tariff outlook, even because the CEO, Cliff Pemble, assured that Garmin is not apprehensive and has a plan to offset them.

I will break down Garmin’s anti-tariff technique and the way it might have an effect on future Garmin watches, however my foremost takeaway from every week of earnings calls — together with Garmin, Meta, Samsung, and others — is that the impression of appeasing shareholders will transcend increased costs.

How Garmin will counterbalance tariffs

“Larger tariffs and extra advanced commerce constructions will likely be a traditional a part of enterprise going ahead,” Pemble warned at first of the earnings name.

1 / 4 of Garmin’s U.S. income comes from merchandise assembled in Taiwan, with a ten% baseline tariff as soon as the momentary exemption expires. Whereas they do not use a “important quantity of fabric” from China, reciprocal tariffs will “weaken the U.S. greenback,” which makes up 60% of their income.

Garmin’s CFO says that of the “estimated $100 million of elevated prices from tariffs” in 2025, they are going to be “principally offset by anticipated favorable overseas foreign money impacts and deliberate mitigations.” To the primary level, Garmin believes that non-U.S. greenback currencies will strengthen, so its 40% of EMEA and Asia enterprise may have inflated worth.

Nonetheless, it is a lot much less particular about its “mitigation” plans. Pemble says that Garmin is “pursuing mitigations, a few of which have already been established, whereas others will take extra time. We’re not ruling something out, and we intend to be strategic and selective with these actions.”

Pemble refused to say what these mitigations are (or will likely be), nevertheless it’s not arduous to surmise.

Garmin’s ‘mitigations’ are hiding in plain sight

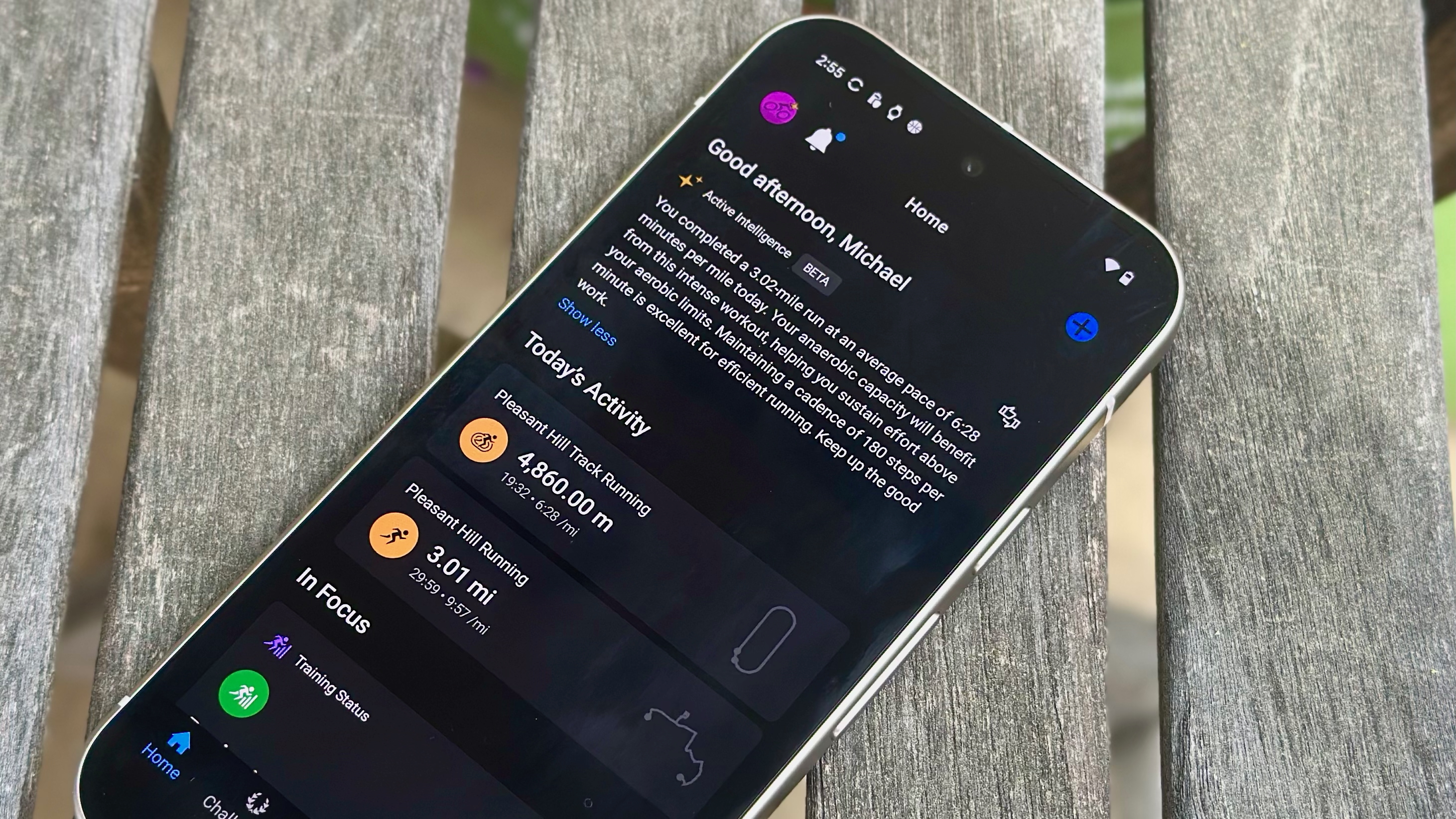

Garmin Join Plus, for all its destructive press and buyer outrage, is an instance of profitable “mitigation” that is already begun. A subscription offers Garmin a brand new income supply, making post-launch updates extra worthwhile as they more and more fall behind a paywall.

Throughout the earnings name, Pemble mentioned that the AI growth made it the “proper time” to launch Join Plus, that “the response has been optimistic,” and that “it is a long-term factor for us, an important a part of our Health phase going ahead.”

I am not so positive in regards to the optimistic response, however Garmin prospects would most likely favor this optionally available nickel-and-dime answer to squeeze out extra money over increased watch costs.

I doubt it is a coincidence that Garmin upped its Health “income development estimate” from 10% to fifteen% after only one quarter, so shortly after the Join Plus launch and with no new main merchandise apart from the Vivoactive 6, which made few upgrades over its predecessor.

The Outside class had Garmin’s greatest YoY income increase with $72.3 million. The Garmin Fenix 8‘s continued recognition is the primary purpose, however the brand new Intuition 3 was one other issue; it added an AMOLED show and higher battery life however in any other case stored to the established order with older sensors and few characteristic modifications for a excessive worth.

Garmin’s 2025 technique with the Intuition 3 and Vivoactive 6 reveals Garmin’s extra delicate, in-progress technique: sticking to a constant launch schedule whereas providing fewer enhancements per technology, so it may well tempt prospects to improve extra typically with out worrying about important innovation.

The truth that Garmin hasn’t given its newest watches the Elevate v5 sensor seems like proof of this technique. Garmin counts on its model power and fashionable coaching instruments to tempt individuals sufficient that they ignore Garmin’s flaws, mitigating the necessity to supply a extra aggressive product.

Some Garmin watches might get dearer

“Every part is on the desk,” Pemble mentioned when requested about elevated Garmin watch pricing to mitigate tariffs. However that does not imply each Garmin watch will likely be dearer.

“We’re evaluating pricing not broadly, however particularly in context of every market and product line,” Pemble defined. “There are instances the place undoubtedly, there’s room to have totally different pricing, and there is different instances [where] it is extra aggressive and tough to extend costs. So we’re managing it case by case.”

The Vivoactive 6, as an illustration, stayed reasonably priced at $299, whereas the Fenix 8 was $200 dearer. My guess is that Garmin will upcharge its premium-tier fashions as a result of it already is aware of prospects can pay above market fee, whereas the mainstream Venus and Forerunners keep low to compete with different health watch manufacturers.

It is also tried promoting extra funds “E” fashions just like the Fenix E and Intuition E that lower main options, like an Apple Watch SE or Galaxy Watch FE. Promoting extra merchandise, from premium to funds, is one other means Huge Tech manufacturers are attempting to fight tariffs.

Look to Huge Tech for Garmin’s future technique

Simply this week, Meta warned shareholders that tariffs might dip Asia-based advert gross sales as much as billions of {dollars}, whereas Samsung’s Q1 earnings defined how tariffs induced a “slowdown in development” and can set off declining smartphone demand.

Like Garmin, these Huge Tech manufacturers tried to assuage shareholders with their plans to counterbalance tariff results. Samsung will “maintain profitability” with the upcoming Galaxy S25 Edge, whereas Meta will depend on Meta AI and Ray-Ban glasses to “offset” losses.

Principally, these firms plan to turn into extra “environment friendly” and reprioritize their product classes to new, untapped areas. And the larger the model, the extra tariff injury they will must mitigate.

*APPLE ESTIMATES $900 MILLION IN COST INCREASES ON TARIFFS IN Q3Could 1, 2025

Garmin might simply deal with that second technique. It already began this pattern with Join+; the following step is extra LTE watches, primarily based on a current Fenix 8 LTE leak.

Some Garmin followers have begged for a Whoop-style band for years, and whereas Garmin is unenthusiastic about good rings, that would at all times change. Heck, Garmin might even revive its defunct Varia Imaginative and prescient lineup as health AR glasses, one other rising pattern.

The purpose is, Garmin sells 100 totally different merchandise a yr; what’s a couple of extra? It could resolve to step outdoors its consolation zone and rush out new product classes it might have ignored in a pre-tariff world, merely to seek out new sources of income.