Regardless that the saga began after the fiscal quarter ended, Apple’s Q2 monetary outcomes are going to be profoundly completely different because of the Trump tariffs. This is what to anticipate from the outcomes on Might 1.

As common as clockwork, Apple might be reporting its Q2 2025 earnings on Might 1, with the outcomes launched forward of the usual analyst and investor convention name at 5p.m. Japanese.

Apple’s CEO Tim Prepare dinner might be on the decision, together with newly-installed CFO Kevan Parekh, to debate the outcomes and to tackle questions from analysts.

Given the turbulent April Apple endured because of the introduction of tariffs towards China and the remainder of the world by President Donald Trump, Prepare dinner and Parekh will most likely have much more questions concerning the provide chain than regular.

Final quarter: Q1 2025 particulars

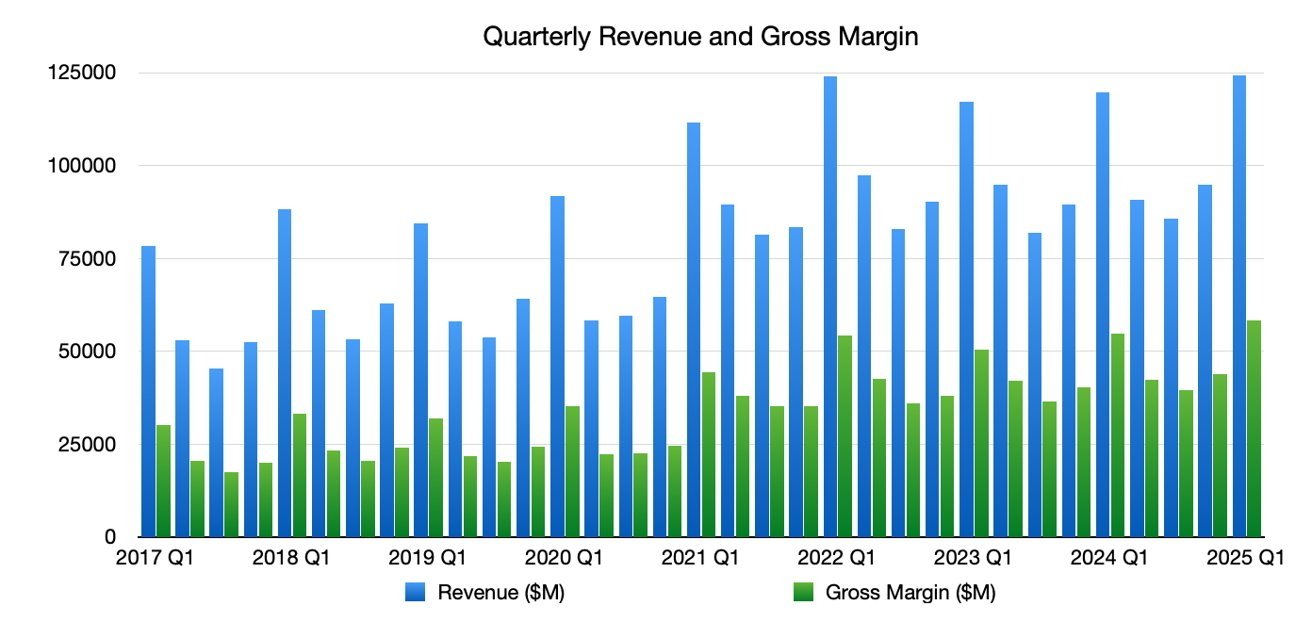

The Q1 outcomes noticed Apple report its highest figures for the 12 months, together with income rising year-on-year to $124.3 billion from $119.58 billion within the year-ago quarter.

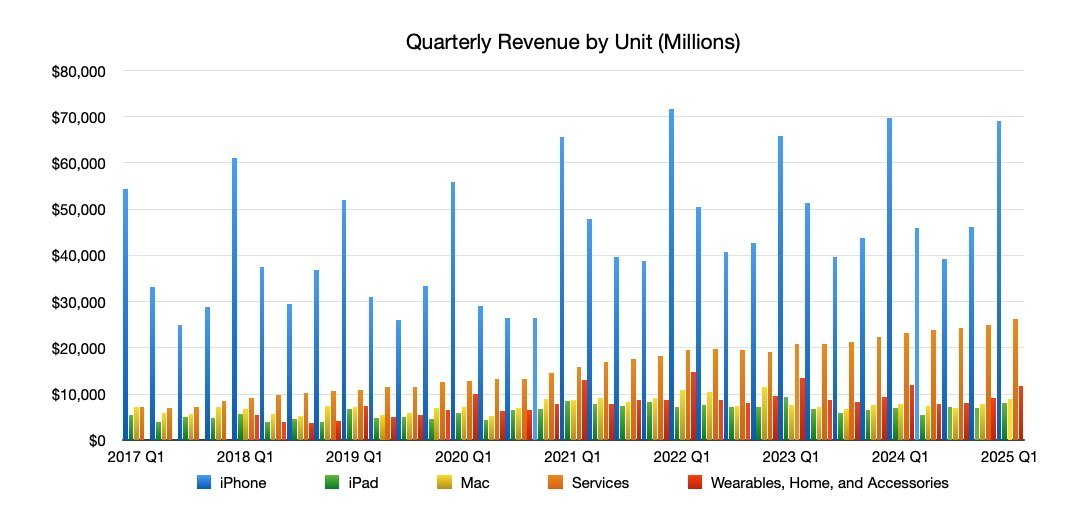

On a unit foundation, iPhone was comparatively flat year-on-year at $69.1 billion for the quarter, iPad rose from $7.02 billion to $8.088 billion, and Mac rose from $7.78 billion to $8.99 billion. Wearables, Dwelling, and Equipment noticed a small dip from $11.95 billion to $11.747 billion.

Providers continued its development streak, from $23.12 billion in Q1 2024 to $26.34 billion in Q1 2025.

That quarter had a number of previous launches, together with the iPhone 16 vary, USB-C on AirPods Max, the Apple Watch Collection 10, and the Black Apple Watch Extremely.

Apple’s board of administrators declared a money dividend of $0.25 per share of frequent inventory. The Earnings Per Share was listed at $2.41.

On a regional foundation, which is kind of pertinent this time round, Better China income noticed a YoY dip from $20.8 billion to $18.513 billion.

12 months-ago quarter: Q2 2024

Usually the benchmark for comparability for the present quarter’s outcomes, the Q2 2024 outcomes have been a little bit of a dip for the corporate. Total income of $90.75 billion was down from the earlier Q2 2023’s determine of $94.8 billion.

Even so, there have been fairly a couple of positives. For a begin, Apple beat Wall Avenue, with its consensus placing Apple’s income at someplace between $82.32 billion and $86.15 billion.

Apple’s EPS of $1.53 was up year-on-year from $1.52, and in addition beat Wall Avenue’s forecast of $1.50.

That quarter had comparatively few product launches, together with the discharge of the Apple Imaginative and prescient Professional, in addition to M3 Apple Silicon updates to the MacBook Air vary.

Income from iPhone was $45.96 billion, down YoY from $51.3 billion. Mac was flat, from $7.45 billion one 12 months previous to $7.2 billion.

There was a dip for iPad from $6.7 billion to $5.56 billion, whereas Wearables, Dwelling, and Equipment shifted downward from $8.76 billion to $7.9 billion. Providers stored up its development development, going from $20.9 billion in Q2 2023 to $23.9 billion in Q2 2024.

What occurred in Q2 2025

As normal for the interval, Apple had some product launches, together with the iPhone 16e, the Eleventh-gen iPad, the M3 editions of iPad Air, the M4 MacBook Air, and an up to date Mac Studio.

Whereas it will not have the identical influence as within the large Q1 outcomes, there’ll nonetheless be the lingering results of product launches from the tip of 2024, together with the iPhone 16 technology, a brand new iPad mini, and the November Mac launches.

These can have a cloth influence on income within the Q2 outcomes.

Put up-quarter Trump tariffs

A present hot-button concern that might be raised through the analyst convention name, and that Apple will most likely advise on, is the state of tariffs. After the quarter ended, the Trump administration determined to concern “reciprocal tariffs” towards every nation on this planet.

Given the risky nature of the state of affairs, it’s nearly sure that the tariffs, and what Apple can do to mitigate their results on the availability chain as an entire, will dominate the analyst chatter.

The tariffs have been heralded very early in Apple’s second quarter, however weren’t applied till April, after the quarter ended. The tariffs will not influence the outcomes of the quarter itself, however will nearly definitely play a think about Q3 and future quarter discussions.

The tariff battle included a interval of tit-for-tat rises, with Trump setting a excessive price for China, then China preventing again with its personal on imports from the U.S., adopted by a response by Trump.

The affair severely impacted Apple’s inventory value, with buyers frightened concerning the potential excessive value rises of Apple items in the USA, attributable to the tariffs.

Ultimately, Apple and different tech corporations got some respite within the type of an exception. That is, nevertheless, non permanent till new “semiconductor tariffs” arrive sooner or later.

China, in the meantime, was fed up of elevating its tariff towards U.S. items, and went a special route. As an alternative, it ceased the exports of uncommon earth minerals and magnets, which may influence provide chains around the globe.

Whereas buyers could also be frightened about future iPhone pricing, it most likely will not have an effect on gross sales that a lot. Analyst analysis has decided that the intention to improve within the subsequent 12 months is at an all-time excessive.

Nevertheless, that survey occurred in March, earlier than the tariffs hit the world. Client opinion might have modified rather a lot since then.

Wall Avenue Consensus

The Wall Avenue consensus refers to a survey of analysts. The outcomes are averaged out to present a common opinion of the place buyers and analysts are leaning of their quarterly forecasts for Apple.

Yahoo Finance

Within the estimates revealed by Yahoo Finance as of April 21, 27 analysts provided a mean income estimate of $93.97 billion. The estimated vary goes from a excessive of $95.9 billion to a low of $89.4 billion.

For the earnings per share, a gaggle of 27 forecasts a mean of $1.61, with a excessive of $1.66 and a low of $1.47.

TipRanks

On April 21, TipRanks provided its personal consensus figures. The income forecast is at $93.94 billion, with a variety from $89.4 billion to $95.9 billion.The earnings per share is predicted to be $1.61, with a variety from $1.47 to $1.67.

Analyst Expectations

As Apple’s outcomes get nearer to launch, analysts provide what they consider might be included within the issued figures, and the place Apple’s future could lead on for the approaching 12 months.

Morgan Stanley

Morgan Stanley’s final main transfer on Apple was a lower of its value goal from $275 to $252 on March 12, earlier than the tariff hassle started. Analysts posited that the continued postponement of Siri enhancements will mood iPhone improve charges.

On the time, analysts diminished the agency’s iPhone cargo forecast for the 12 months to 230 million items, equating flat shipments year-on-year, however rising to 243 million in 2026. The slower-than-expected iPhone substitute cycle additionally lower down Morgan Stanley’s full-year income estimate to $436 billion.

On April 22, it reaffirmed its “Chubby” ranking and a $200 value goal.

Wedbush

On April thirteenth, Wedbush lowered its full-year earnings per share estimates for Apple, from $7.44 per share for the 12 months to $7 flat. Wedbush’s consensus estimate places Apple at $7.28 for the full-year earnings

Wedbush holds an “Outperform” ranking for Apple, with a $250 value goal.

Goldman Sachs

On March 6, Goldman Sachs reaffirmed its “Purchase” ranking for Apple, with a value goal of $294.

The choice adopted Apple’s March Mac updates, which Goldman Sachs analysts believed would assist Apple attain a Q2 income development goal. That development is not large, with low to mid single-digit motion anticipated at round 6%, and an estimated income determine of $95.9 billion.

Evercore

On April 15, Evercore believed Apple was poised for upside within the quarter, however stated the main focus is on Q3, and the way Apple offers with the tariffs. This included utilizing plane and its logistical prowess to import merchandise into the USA.

Total, Evercore maintained its “Outperform” ranking for the inventory, with a value goal of $250.

UBS

On April 14, a UBS be aware to buyers provided that Apple had a robust monetary well being rating. It had a strong place with $137.53 in EBITDA and a 46.5% gross revenue margin that served as a buffer of kinds towards regulatory points just like the tariffs.

It maintained a “Impartial” ranking for Apple, with a value goal of $236.