A panel at PTC in Hawaii comprising hyperscalers Google and Meta and wholesalers Exa Infrastructure and Southern Cross Cable Networks explored how AI is reshaping demand for submarine cables, driving hyperscaler-led builds, stressing legacy programs, and creating new regulatory and supply-chain challenges for the business.

In sum – what to know:

Exploding demand – AI is reshaping subsea cable infrastructure, with new trans-atlantic/pacific routes wanted; however getting old programs, difficult enterprise circumstances, and regulatory and logistical constraints abound.

Altering fashions – wholesalers like SCCN and Exa have shifted from serving carriers to hyperscalers; operators face challenges with rising bandwidth, capability allocation, and strategic community planning.

Mounting issues – deployments are constrained by tech roadmaps and provide bottlenecks; plus there are main disconnects with knowledge centre builds, terrestrial fibre initiatives, and authorities intervention.

Extra notes concerning the state of the subsea cable business within the AI period – taken from a panel session at PTC in Hawaii a few weeks again, a few of which has been coated in these pages already. Observe, this might be a shorter round-up than final time, given time constraints at RCR. The dialogue to this point has been about transatlantic subsea infrastructure, and the necessity for brand new cables between North America and Europe. As we had been; Jim Fagan, chief govt at EXA Infrastructure, says his agency is seeking to construct new cables within the area, probably to the north.

“The north… has type of been uncared for, and [you] assume the place [new] knowledge facilities are going… [into] the Nordics,” he stated. “There’s demand… [and] we predict it is likely to be time for an additional one, and we glance to go ahead with that. It’s completely going to be a Northern Atlantic route.” Only for context, cables will go to wherever there may be energy, and a enterprise case for an information centre – somewhat than the opposite method round. “Theoretically, we are able to construct subsea cables wherever,” stated Nigel Bayliff, senior director for world submarine networks at Google.

“There’s a transfer to [build data centres in] Scandinavian nations, the place there’s extra energy and it’s colder. Taking cables to the excessive Arctic… might be extra possible than shifting an information centre to a scorching nation with a straightforward place to land a cable. In the event you consider the amount of cash being spent on knowledge facilities versus the quantity on subsea cables, then it’s completely applicable that we simply go to the place they’re.” Apparently, Bayliff additionally made the purpose that subsea infrastructure is less complicated to set down, typically, than terrestrial fibre networks – even given the paperwork concerned.

“It’s the terrestrial networks which are exhausting to get to the degrees wanted for a few of these giant deployments – shortly. It typically takes longer to type out 4 or 5 routes via distant components of Finland than to land a cable on the Norwegian shoreline.” It’s not simply within the Atlantic, in fact; the subsea crunch is world, variously, as demand spikes on new AI ventures and legacy programs, constructed for the final large tech bubble, develop into out of date. Laurie Miller, president at Southern Cross Cable Community (SCCN), owns trans-pacific cables that had been commissioned in 2000.

He mirrored: “Our system went in 25/26 years in the past, so it’s end-of-life. We’ve loved run there – 21 years as a dominant supplier on that route. There’s clearly demand; Australia is turning into extra vital from a geopolitical perspective – by way of knowledge facilities and connectivity on a southern route. Demand is pushing the necessity for higher provide below water. However we’re a wholesale operator like Jim and the wrestle is the enterprise case. That’s the hardest justification.” The final half, right here, is value unpacking – in case you don’t know.

Hyperscale programs

Miller’s level is that wholesalers like SCCN and Exa used to serve terrestrial telecoms carriers, needing worldwide capability for voice and early web visitors. The outdated mannequin was that it served a comparatively small variety of telco patrons on predictable long-term contracts. SCCN is owned by carriers – as a three way partnership by Spark in New Zealand, Singtel-owned Optus in Australia, Telstra in Australia, and Verizon Enterprise within the US – and so its incentives had been aligned: carriers wanted trans-national capability, and it owned subsea cable to cross the Pacific.

However new demand just isn’t from conventional carriers, any longer – it has been coming from cloud corporations for a decade, a minimum of, and is newly exploding with their AI agendas, particularly in Australia and alongside new “southern routes”. Miller famous: “The carriers will not be the hyperscalers; they’re promoting to the hyperscalers. The demand drivers have modified, and we now have to alter with that.” The purpose is that, even regardless of rising demand in an important area for visitors development, carriers are now not the top prospects, and hyperscalers have routes of their very own and loopy shopping for energy.

He added: “The hyperscalers are our prospects. That’s the underside line. We do not need natural development… AT&T was once the dominant [player]; it was the service membership. We had been a part of it. However we’ll evolve… We all know who our prospects are, and… we [know] there’s alternative and we all know there’s a threat additionally – as a result of we now have to search out the correct companion, and work with them to know the place to construct. We’ve acquired to do the dance with the financiers and shareholders, and produce that collectively. It’s no easy activity, however historical past says we’re up for it – that it’s what we do.”

His feedback reveal the challenges within the broader business, in addition to the tensions on the panel – between the outdated subsea mariners and the brand new lords of the deep. There’s a problem as effectively only for subsea wholesalers to get a few open channels on the newest fibre crossings, as set down by the likes of Google and Meta. Fagan at Exa remarked: “It’s fantastic they’ve all this demand, they usually’ve acquired the money to construct… [But] historically, 1 / 4 to a 3rd of [their capacity] got here again available on the market…. [and now] they’re getting instructed to maintain all of it.”

He went on: “I get the query [about whether AI will] derail us [but] the actual fact is we see… how AI is used. Again within the day, monetary providers wished one gig or 10 gig; they’re all now asking for 100G or 400G as a result of they’re ingesting their knowledge into their AI fashions… You may see the place this development begins to blow up. The problem is that they’re beholden to their use circumstances, and people are beginning to get stretched. So that is the time the place, as a wholesale business, we now have to come back collectively and work out how… to construct into that world visitors mesh. It’s going to be an enormous mindset shift.”

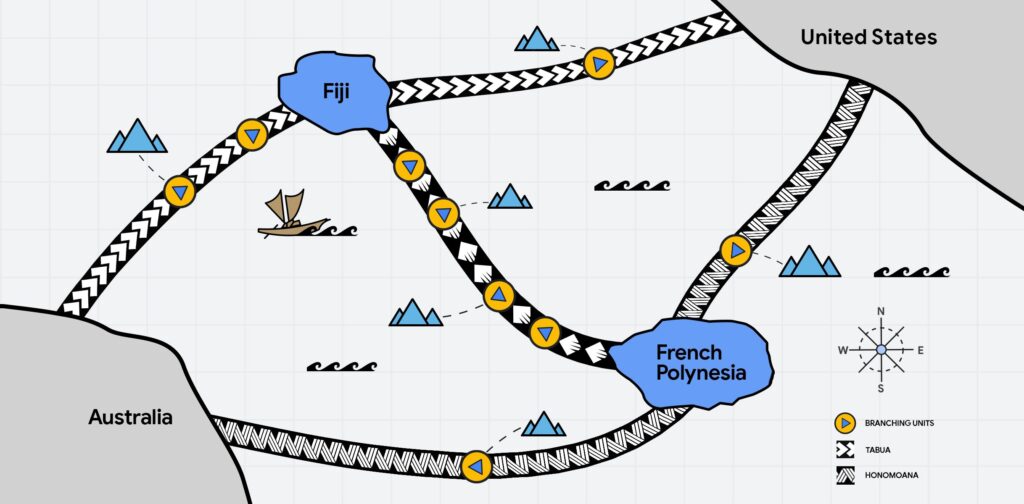

Bayliff reassured that Google’s two new trans-pacific cables (Honomoana and Tabua, a part of its South Pacific Join venture; “about to finish”) will return capability to the open market. “Six of the fibre pairs on every of these went to industrial events. The plan might be eight and eight, and one of many cables can have a distinct allocation combine.” In different phrases, every system can have eight fibre pairs, in keeping with trendy subsea designs, and that one of many two cables in every will serve extra routes or completely different branching paths – cater to completely different industrial necessities.

Industrial entry will fluctuate barely relying on route complexity and strategic use, however wholesale carriers, telecoms suppliers, and massive multinational enterprises can have entry to capability, both by buying full fibre pairs or spectrum on the fibres. He added: “The general intent is that, below our customary mannequin, carriers and collaborating events will all the time be capable to entry these programs on the fibre-pair or spectrum degree.” What does Meta say? The query was posed by the panel host, Thomas Soerensen, accountable for subsea options at Ciena.

Will Meta use all of the capability on its new routes? Nico Roehrich, director of community investments within the APAC area at Meta, responded: “It’s troublesome to say. We’ve got six fibre pairs in manufacturing, [and] we by no means imagined we would want all six. We additionally didn’t think about it will take twice so long as the unique plan. So it’s a bit of bit [like] insurance coverage. We wish to go as large as we are able to so we now have the flexibleness. We’re a vital a part of the ecosystem, and we’ve invested in consortia programs for years… We’re conscious of our function and wish to be respectful. However the lead instances…”

Disconnects in all places

Certainly, Roehrich is hitting on the broader challenges to deploy subsea cable. Bailiff’s earlier level that it’s less complicated to deploy than terrestrial energy or fibre to knowledge centres is likely to be proper, nevertheless it’s nonetheless a posh endeavor – and turning into extra so. The enterprise case is complicated, the panel agreed, and the know-how now not affords a lot flex for future capabilities. “We’re method nearer to Shannon than ever earlier than,” stated Roehrich, citing Shannon’s regulation, defining the theoretical-max for error-free knowledge over a comms channel with a selected bandwidth and signal-to-noise ratio.

It’s the usual rationalization as mad-paced tech innovation assessments the legal guidelines of physics. He defined: “We’re not going to have the identical degree of upgradability as previously. Meta is concentrated on constructing the fattest cables it may well – as a result of we don’t see the identical features as previously. Which speaks to the enterprise case, in fact. As a result of you recognize the whole capability of the cable from day one just about, and you’ll’t issue within the type of future incremental acquire that you just used to have the ability to.” As above, the case can be difficult by lengthy lead instances for brand new fibre optic cables.

It’s a pure consequence of a hyperactive market, in fact, plus supply-chain bottlenecks (too few producers, vessels, distributors) – uncovered throughout Covid and exacerbated by demand. “We’ve gone from 18 months to 48 months as the usual lead time to construct a cable,” stated Roehrich. “The mixture of lengthy lead instances and fewer upgradability is a problem.” However there are “disconnects” in all places, it appears – with knowledge centre builds, with terrestrial fibre deployments, and with governments round funding and regulation. The panel picked via these points in flip.

Miller at SCCN stated: “We’re in a cycle. It’s disjointed for the time being. I don’t assume there may be a variety of coordination between knowledge centres and submarine cable programs, and the funding cycles are so completely different. We’re constructing a 25 12 months asset and an [AI] chip is out of date in two years. So attempting to marry these two funding cycles is admittedly exhausting.” Fagan at Exa had an analogous story, suggesting there stays a misperception, in some quarters, that operators can “drop in 96 or 144, and even larger” onto a regular 24 fibre-pair subsea system – as they might on land.

The distinction is a subsea system, as soon as deployed, is fastened, and likewise massively capital-intensive and constrained by ship instances, manufacturing slots, and route permissions. “They assume subsea and terrestrial are the identical,” he stated. You may’t overbuild, parallel-build, or re-pull fibre below the ocean – like land lubbers among the many fibre group. He added: “There’s this disconnect with the funding cycle and the fee and the timing of it. Wherever you’re going, there might be wash-outs the place some amenities are over-financed and don’t get connectivity.”

Roehrich chimed in: “We’ve undoubtedly seen bulletins withdrawn – the place folks say they’ll put an information centre right here as a result of they’ve acquired megawatts of energy, after which [cancel the project] three months later as a result of they’ll’t hook up with it.” The purpose is to do due diligence on new initiatives, responded Fagan. “We have a look at the feasibility of the ability earlier than constructing to it – as a result of I’ve finite capital. A variety of the data-centre cash during the last three years [unravels] as amenities develop into operational and don’t have the correct connectivity.”

However on stability, a lot of the panel’s ire – or dialogue, anyway – is about authorities funding and regulation. A part of the problem, and alternative, is to work with governments on the reuse of cable routes and touchdown stations – with a view to “reduce off a 12 months or two” for brand new deployments. “It [would make] an enormous distinction proper now in the event you have a look at the capability [demand],” stated Fagan. Meta want to reuse some infrastructure as cables retire, stated Roehrich. However there are points, typically – newly-formed/designated marine sanctuaries excessive, he advised.

“There’s an actual alternative for business and authorities to work collectively to determine easy methods to make this simpler.” Roehrich, specifically, was candid on the panel about authorities collaboration. “For many of what we’d like, we couldn’t wait for presidency determination making timelines,” he stated. “There have to be others, possibly with much less capital than us, who can… [wait for] authorities funding to construct one thing distinctive, however, for us, time is probably the most vital.” However Meta’s largest headache, it appears, is getting authorities approvals to plan, lay, and function submarine cables.

Authorities oversight

These embrace nationwide permits from coastal states to enter territorial waters, environmental approvals to navigate fisheries and marine ecosystems, right-of-way permits with port authorities and native communities, and varied different coordination to cross geographic territories and financial zones. Plus, there are hazard zones, in fact, the place subsea cables get, deliberately or unintentionally, dragged by anchors from fishing boats. For Meta, that is the day by day grind, and adequate for its huge Challenge Waterworth to take bizarre routes to navigate regulatory bottlenecks.

Challenge Waterworth represents the world’s longest undersea fibre‑optic cable system, spanning about 50,000 kilometres and linking 5 continents. Roehrich defined: “It is rather a lot pushed by range. Extra range is healthier, by way of the place the cable lands and the place it’s routed. Not surprisingly, allowing is a serious driver. It’s a case of the place we predict we are able to construct, with probably the most predictable allowing, or the least prone to go sideways… It’s a type of issues the place we’re uniquely positioned to construct one thing that basically doesn’t make a variety of sense.

“In the event you have a look at the routing, there are some deep water advantages, however it’s dearer than going from A to B on a conventional route. If we had been to attempt to promote it, I assume there can be no curiosity as a result of the latency is so excessive. So for us, it was actually [about] insurance coverage. The query is whether or not that insurance coverage coverage ever pays off. However total, we’re being pushed by governments and coverage choices to go to new locations – which is web useful for resiliency within the community, for the ecosystem as a complete, however in all probability doesn’t make sense for conventional telcos to speculate.”

The opposite authorities tangle for the subsea sector, as mentioned at PTC, is with the business’s new designation as “vital infrastructure”, reflecting the popularity that submarine cables are necessary (greater than) to nationwide safety, financial stability, and digital sovereignty – and in course of variously in Europe, NATO allies, and UN boards since 2023/24, precipitated additionally by rising geopolitical tensions. However some type of disputed extra accountability comes with the designation, because the EU, notably, seeks to introduce naval vessels to patrol infrastructure within the North Sea.

Fagan responded: “It’s a very large matter; we now have these discussions with the EU, UK, US, and, to not be egocentric, however we get requested [to provide] safety… And for a personal operator, it’s like, yeah, if you wish to assist me pay for it… Proper now it appears to be a bit greater than discuss; like there may be some motion. Governments try to get their heads round it… It’s like a brand new paradigm – like mushy warfare or mushy energy. The excellent news is the conversations are there, and the schooling has occurred. However so far as tangible options go, which let me sleep higher at evening, [there’s work to do].”