Nokia noticed web gross sales rise by three % final quarter and two % in the entire of final 12 months, whilst margins slipped, partly due to investments and restructuring. Income progress got here largely from robust fiber-optic and knowledge heart demand, it mentioned. Nokia is doubling down on its big-ticket community infrastructure technique, centered on large-scale mobile and fibre deployments. Its different selections nonetheless look unusual.

In sum – what to know:

Optical and IP – longhaul/backhaul optical orders jumped 17% in This fall, and Nokia expanded its presence in knowledge heart IP routing and switching, focusing on hyperscaler and AI prospects.

Revenue pressures – working revenue fell 37% within the quarter and 55% for the 12 months, as a result of Infinera acquisition and R&D spending, although comparable working revenue declined a lot much less.

Strategic AI shift – the corporate is prioritizing ‘community infrastructure’ and ‘cell infrastructure’ segments, slimming down legacy and campus-edge companies, and focusing on €2-2.5 billion in comparable working revenue for 2026.

Nokia has reported modest top-line progress within the quarter and the 12 months, with web gross sales climbing three % as demand for fiber-optic transport and knowledge heart connectivity, notably from hyperscaler and AI-focused prospects, offset softer efficiency in legacy models. Which largely seems to justify the Finnish agency’s strategic pivot, introduced in November, to a two-lane big-ticket infrastructure proposition round large-scale mobile and fibre networks – and away from its non-core companies, nevertheless acquainted, progressive, or market-leading they’re.

Besides a few of its language round personal networks nonetheless sounds humorous, making its broader technique nonetheless sound simplistic, and somewhat unhappy. Extra on this in direction of the underside; however the high line outcomes, which noticed its share worth slip by round 10 % after the announcement (and rally since), are as follows..

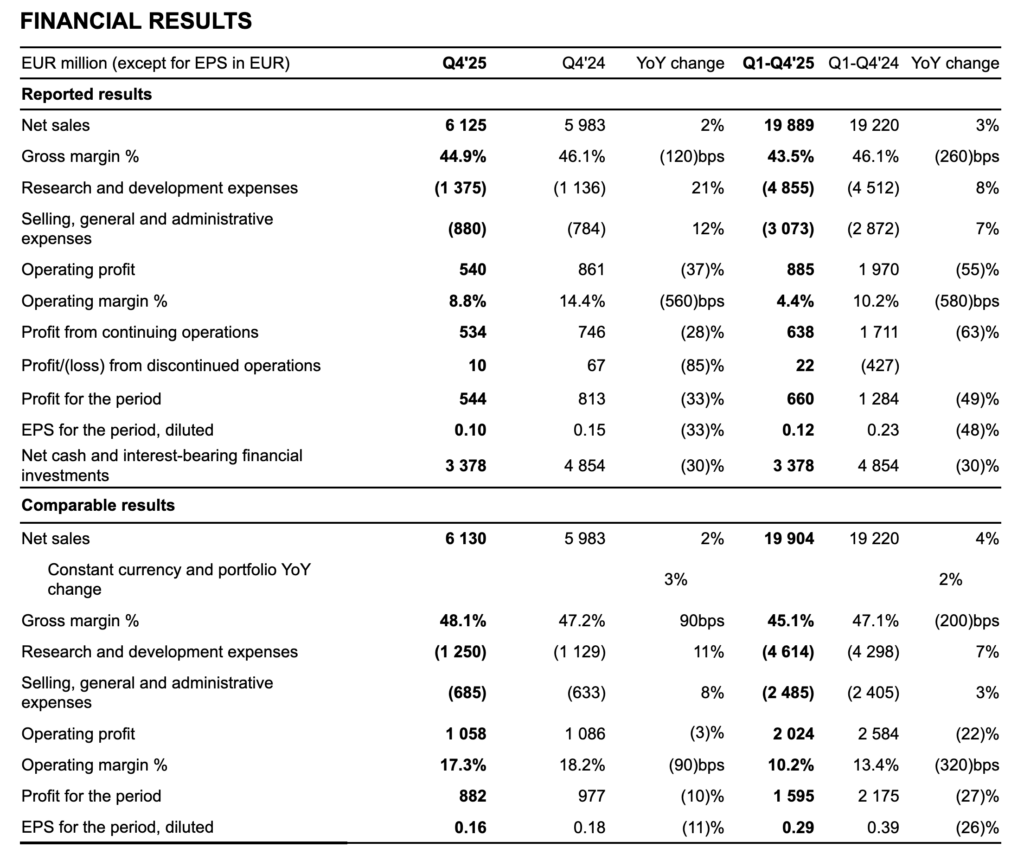

Nokia’s 2025, in evaluation

Nokia noticed web gross sales climb by three % within the fourth quarter versus the year-ago interval, reaching €6.1 billion within the three months to the tip of 2025; its full-year gross sales in 2025 had been two % larger year-on-year, ending at €19.9 billion for the 12 months, two % larger than 2024 – on a continuing foreign money and portfolio foundation, as if exchanges charges weren’t a factor and the enterprise had not purchased or bought property between occasions; they had been up two % and three %, respectively, as reported figures. The Finnish agency mentioned efficiency was “in step with expectations”.

Working revenue was down 37 % within the quarter and 55 % within the 12 months – to €540 million and €885 million – on account of its acquisition of Infinera for $2.3 billion in early 2025, plus “growth-related investments in R&D”. On a comparable foundation, working revenue was nonetheless down, however by significantly much less – at simply over €1 billion and simply over €2 billion throughout the 2 durations, respectively, down by three % and 22 % versus 2024. Nonetheless, these returns completed “barely above the midpoint of our steerage”, the corporate mentioned.

Profitability improved barely within the quarter, with gross margin rising 0.9 proportion factors to 48.1 % – due to extra enhancements in its ‘cell networks’ and ‘cloud and community companies’ models, it mentioned, regardless that its outdated ‘applied sciences’ enterprise contributed much less. However its full-year rating was down by two proportion factors to 45.1 %. Working margin was down by 0.9 % within the quarter and three.2 % within the 12 months – to 17.3 % and 10.2 %, respectively. The agency cited investments in progress areas, together with to purchase Infinera, plus decrease gross margin.

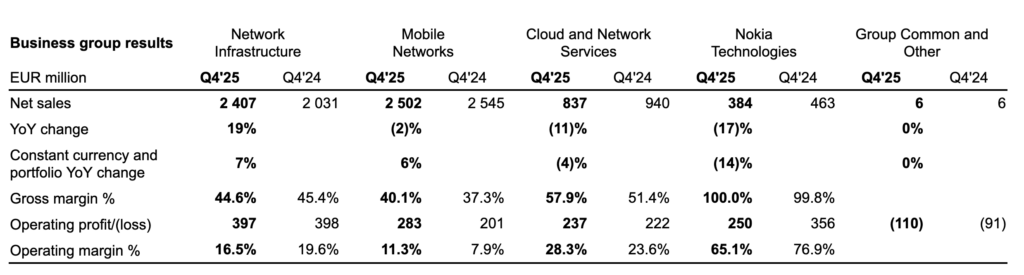

Like for like, its historic enterprise models noticed quarterly net-sales enhancements/declines as follows: ‘community infrastructure’ and ‘cell networks’ had been up by seven % and 6 %, to €2.5 billion and €2.5 billion, respectively; ‘cloud and community companies’ and applied sciences’ companies had been each down, by 4 % and 14 % to €837 million and €384 million. There was no break-out or particular point out of the corporate’s good work within the (campus-sized) personal networks enterprise, as underneath earlier stewardship.

Nokia mentioned it’s focusing on a unfastened €2-2.5 billion vary for comparable working revenue in 2026 – so someplace between flattish and steep progress, as much as 25 % on the high finish (simply over €2 billion in 2025 versus a top-line forecast of €2.5 billion in 2026).

‘Lengthy-term’ AI paying off

Some element was supplied about every unit in an earnings name yesterday (January 30). Development in community infrastructure within the quarter included a 17 % soar in gross sales of longhaul/backhaul optical gear to “AI and cloud” prospects – to the tune of €2.4 billion (“in orders”). Justin Hotard, president and chief government, mentioned Nokia has “a long-term view”. He mentioned: “Optical… can be an much more vital half… to assist the AI tremendous cycle. We’re investing to seize near-term demand whereas sustaining a long-term perspective.”

He claimed early delivery and design wins for its 800G ZR and ZR+ gadgets, together with into “scaled deployments”. He cited “additional progress” in web protocol (IP) networks, within the routing and switching layer, for knowledge centre, enterprise, and metro connectivity. He cited “order consumption” inside knowledge centres, plus launch of a brand new switching platform (7220 IXR H6, utilizing Broadcom’s 102.4 Tbp Tomahawk 6 Ethernet change silicon), a brand new agentic AI resolution for event-driven automation administration, and a design win for its latest knowledge heart switching platform.

“These are encouraging steps, and we proceed to imagine income will ramp over time as we develop our presence on this quickly rising market,” he mentioned. In the meantime, ‘mounted networks’ – for last-mile IP and optical componentry – was flat, partly because it has “deprioritised” buyer premises gear merchandise with its November rejig. “This mirrored progress in fiber optical line terminals of 16% offset by softness in elements of the portfolio we’re de-prioritizing,” mentioned Hotard. There’s extra on its surplus carve-up and sell-off technique under.

In any other case, he mentioned ‘cell networks’ noticed web gross sales develop by six % within the quarter and hardly in any respect (“flat”, once more) within the 12 months, whereas ‘cloud and community companies’ went the alternative manner, successfully – 4 % down within the quarter and 6 % larger within the quarter, inside a wider market that declined by two % total, apparently. “Our cloud-native core stack [is] rising quicker than the market and bettering profitability,” mentioned Hotard. He cited offers with Telia, plus with Bharti Airtel (“collaboration”) for its ‘network-as-code’ API platform.

Seventy-five companions, together with 43 telcos, at the moment are utilizing the latter. Its RAN enterprise, united with its 5G/6G core community proposition inside its new ‘cell infrastructure’ enterprise, noticed “disciplined execution in a largely steady market”. The agency has new RAN offers with Telecom Italia, Telefonica Germany, and SoftBank; it’s investing in 5G Superior and open RAN, and it additionally has this $1 billion funding from Nvidia with an eye fixed on 6G and AI-native networks. However it’s price contemplating Nokia’s progress right here in gentle of its new construction.

Out with the good-old stuff

In November, Nokia mentioned it’ll break up its enterprise into two segments to align with the “AI supercycle”. Its new precedence models, lively now, will ship ‘community infrastructure’ and ‘cell infrastructure’. The primary includes optical, IP, and stuck networks, and is pitched as its “progress section”; the second combines its mobile core and radio portfolios (plus ‘know-how requirements’, previously ‘applied sciences’), and drive its 6G ramp-up – presumably as a post-2030 ‘progress section’, whereas it gambles on AI infra between occasions as telcos see out the final days of a grim 5G funding cycle.

As properly, in fact, Nokia has sidelined a bunch of non-priority affairs as ‘portfolio companies’, and lower jobs left and proper. These embrace its divisions for ‘enterprise campus edge’ options (its personal 5G unit; a part of its now-defunct ‘cloud and community companies’ division), fixed-wireless entry {hardware} (a part of its outdated ‘community infrastructure’ unit), and microwave radio options (a part of ‘cell networks’). Every thing is up on the market. About its personal 5G enterprise, which has executed properly over the previous 5 years to interrupt open the entire industrial market, Hotard didn’t say something.

There have been no questions on it from town analysts on the decision, both. As an alternative, he referenced Nokia’s choice to proceed with bigger macro-style personal 5G deployments for sure sectors, and talked in a Q&A session about “encouraging progress on mission-critical… in choose vertical markets that worth, scale, safety, and availability – clearly, issues we deliver from our legacy on this area [with] telcos”. Which makes very clear, if it wasn’t already, that Nokia is getting out of the excitable campus-edge market – the place offers are extra quite a few, however smaller.

He additionally talked about Nokia’s work with navy installations – which is curious, to an extent, given what number of campus (or smaller) sized Nokia-made personal 5G methods are already in use by navy forces, notably within the US. He referenced the creation of Nokia Protection, described as an “incubation unit to function the central R&D hub” for its “go-to-market for our protection portfolio”. He said: “Our precedence is to ship defense-grade options based mostly on Nokia’s cell and community infrastructure applied sciences for Finland and different NATO international locations. Nokia Protection additionally consists of Nokia Federal Options within the US and consists of the know-how we acquired from Phoenix Group in 2024.”

He added: “Based mostly on suggestions from prospects, we see rising demand for our 4G and 5G know-how in navy environments, each for nationwide safety and tactical purposes. That is an space the place we’re persevering with to take a position, and we are going to share updates as we make additional progress.” It’s complicated, for positive, as a result of Nokia’s campus methods, drone options, and creating strains of business gadgets and wearables, pioneered by and being-sold with its ‘enterprise campus edge’ division, are a serious provider of such “tactical” options for navy utilization.

However prefer it or not, Nokia’s focus is identical as everybody’s proper now: the right way to hook as much as the hyperscaler-AI gravy prepare. Hotard mentioned: “Wanting forward, our focus is on disciplined execution to seize progress in AI and cloud and improve effectivity whereas we’re constructing a high-performance tradition throughout ‘group Nokia’. We now have fewer, clearer priorities, a simplified working mannequin, and a method we’re executing with pace and accountability. Community infrastructure stays our main progress engine, notably optical and IP networks, the place we see robust structural demand.”

Cellular is so final 12 months, appears to be the message – when conventional cell is last-decade, and new cell, like vital and tactical edge options, is so now.